Is Bilt 2.0 Worth It?

Vibe-coding an answer over the weekend

Hey everyone, long time no see.

I’ve wanted to get back to writing on this newsletter (thank you to the subscribers for sticking around!) Expect more from me in the new year on a whole bunch of topics! Of course there will be a lot about AI, but there’ll also be just slice of life questions that I find interesting and will explore (like today’s edition) and hope will be a good read for you as well.

Hope everyone is having a great start to 2026!

The gist: Check out my app here to help you decide if Bilt 2.0 makes sense for you!

Is Bilt 2.0 worth it?

Like a lot of people over the past week, I asked myself that question. After an embarrassingly long time searching, reading X/Reddit and watching TikToks on the subject, I walked away more confused than informed.

So I built myself an app.

How did we get here?

🧠 What used to be a no-brainer credit card with Bilt 1.0, suddenly became a big-brained endeavor with Bilt 2.0.

✅ Before: “Pay rent, get points.”

❓ Now: “Calculate your spend-to-rent ratio, Use Bilt Cash to offset your rent/mortgage fees (huh?), Choose multiplier tiers, etc...”

All this was a consequence of having a product too good to be true.

The Loophole

🍌 “Four bananas and rent” became a meme from the loophole customers used to spend the bare minimum number of transactions and still get points for rent while moving other spending to more profitable cards

The result was that Bilt and their partner Wells Fargo were hemorrhaging money. People weren’t spending enough or carrying balances. It was so bad that Wells Fargo had to bail out of their partnership, leaving Bilt to pivot to a 2.0 strategy

So now enter Bilt 2.0 which in any way you slice it boils down to:

Bilt 1.0: Earn points on rent.

Bilt 2.0: Earn points on rent, but only if you also spend enough elsewhere to "unlock" them.

But the process and calculus needed to figure out what was the best way to use the card plus a lot of mixed messaging across the internet led Ankur Jain, CEO of Bilt to write this note on Jan 16th to try to simplify things

So instead of trying to do the mental gymnastics myself to figure this out, I leveraged Gemini and Claude Code to build an app that leveraged documentation from Bilt and analysis from The Points Guy to help make a decision that made sense for my family’s situation.

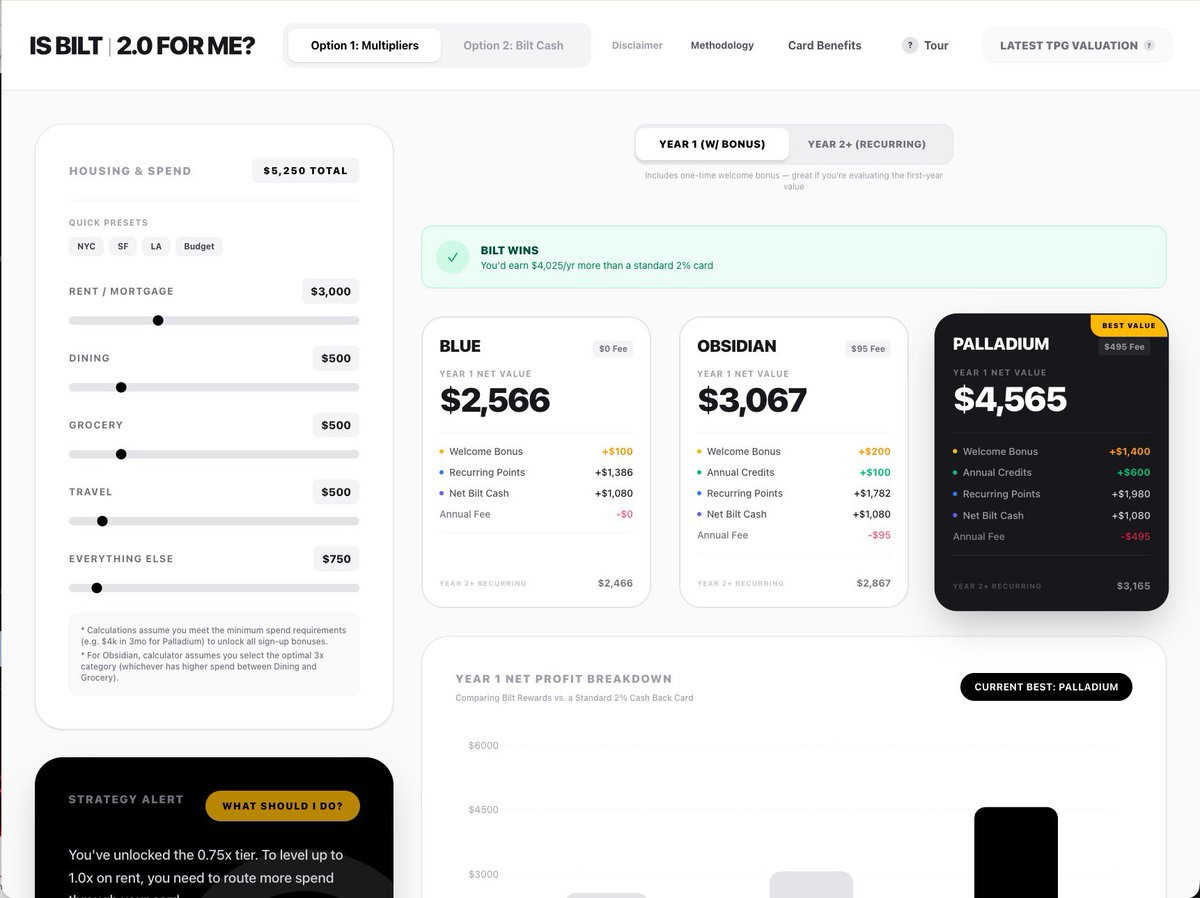

Enter: "Is Bilt 2 For Me?"

https://is-bilt2-for-me.pages.dev

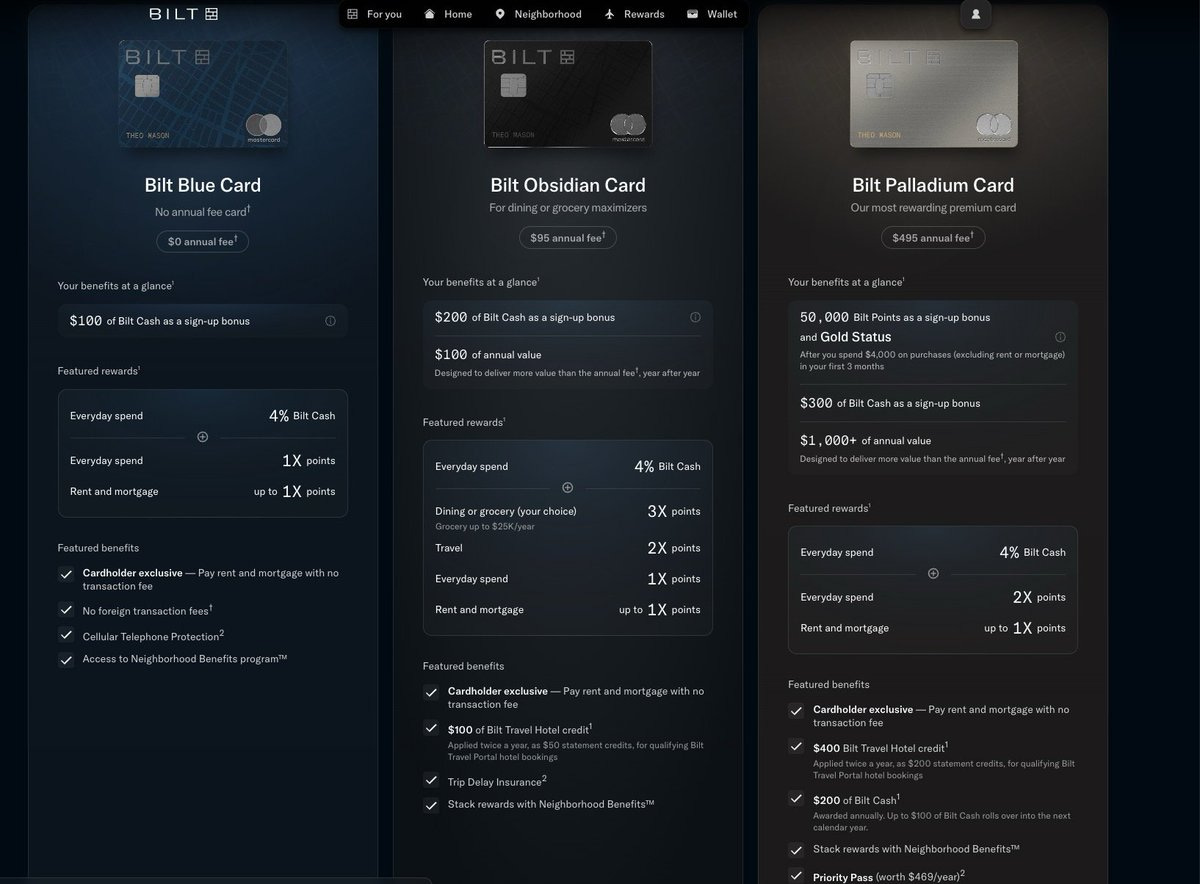

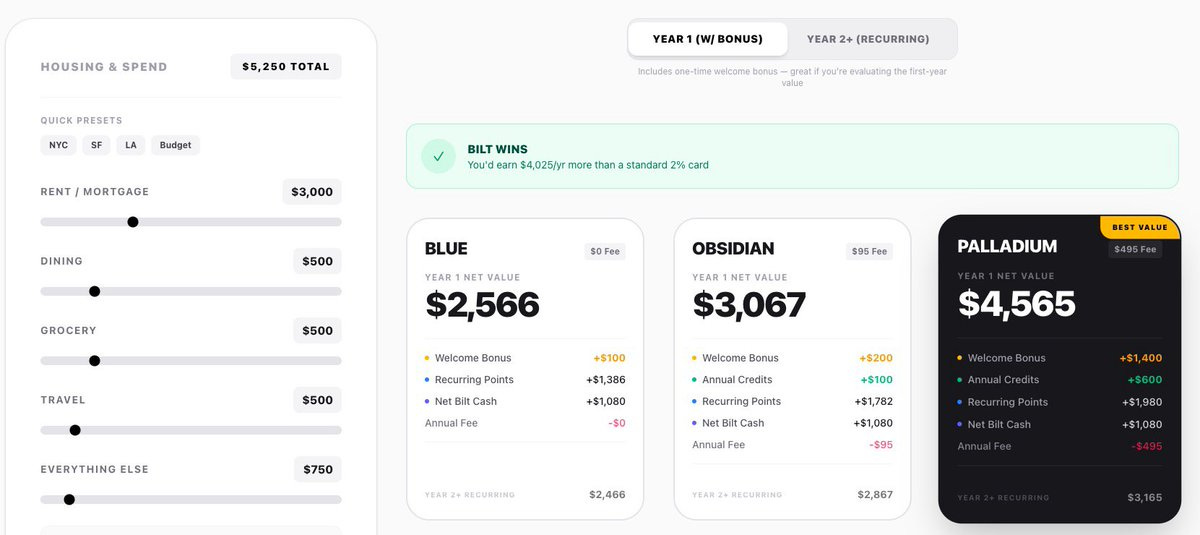

At its core, the app is a simple calculator. You enter your numbers, it tells you which card (if any) makes sense, and does the calculations for you to give you a grounded, specific recommendation

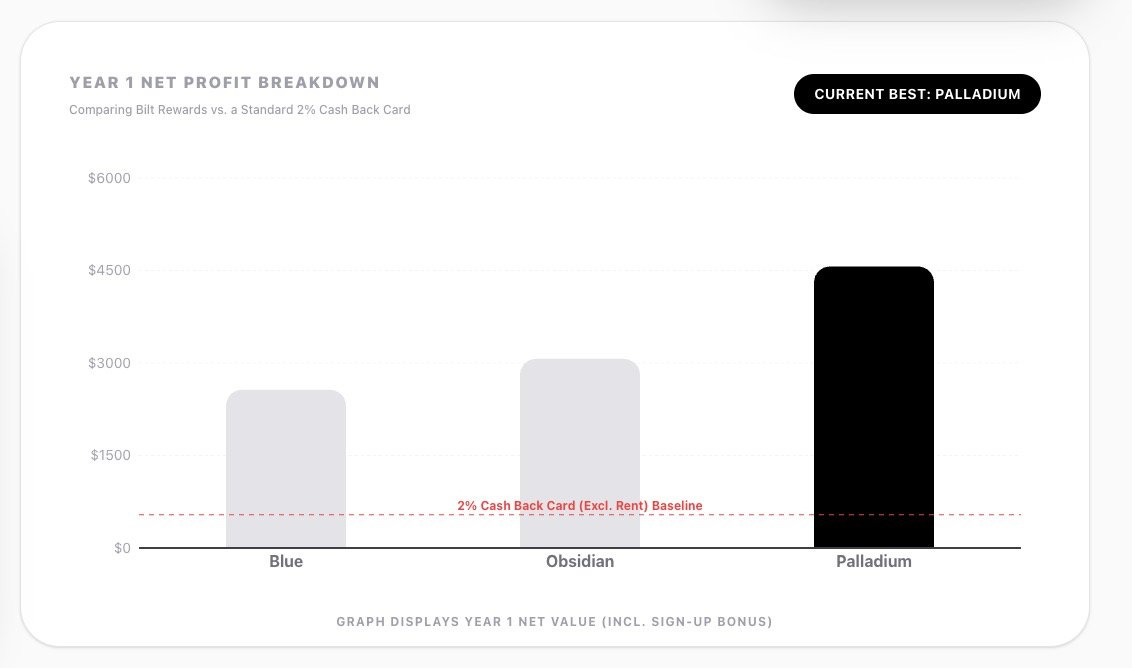

The app uses a standard 2% cash back card as a baseline, and will show whether Bilt nets ahead, giving you a breakdown of the profit in Year 1 when you have sign-on bonuses vs Year 2 and beyond when you have to rely on the merits of the card without bonuses.

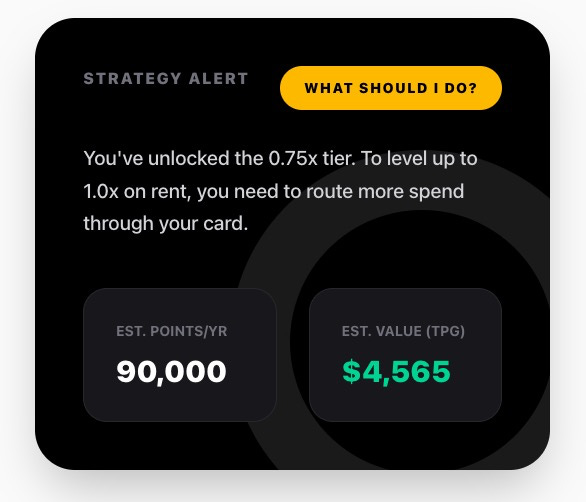

It'll also give a contextual recommendation on which card makes sense given your spending habits with estimated values of how many points (and what that translates to in $) you can expect to earn each year.

So what's my TLDR for Bilt 2.0?

It really only makes sense if you use the card for most of your purchases. If you want to really unlock the full value of your rent/mortgage points, you have to spend close to the same amount (75%+) on non-housing categories.

Given that housing makes up the most of an average person’s spend, is that reasonable? That’s the question people considering Bilt 2.0 really need to answer.

Hopefully my app can help!

The app is completely free to use! DM me if you have any feedback. And if it could be useful to a friend, please share it!

Cheers!

-Alex